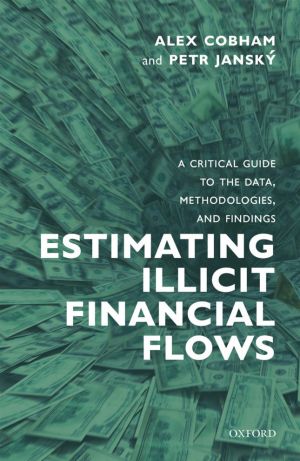

Estimating Illicit Financial Flows

A Critical Guide to the Data, Methodologies, and Findings

by Alex Cobham, Petr Jansky

DescriptionTable of ContentsDetailsHashtagsReport an issue

Illicit financial flows occur through many different channels, whether they involve laundering the proceeds of crime or shifting profits of multinational companies. These deliberately hidden cross-border movements of assets and income streams depend on a set of common tools including opaque company accounts, legal vehicles for anonymous ownership, and the secrecy jurisdictions that provide these series. The overall effect is to reduce the revenue available to states and to weaken the quality of governance - leading to less money to support human development, and a lower likelihood of funds being well spent.

Estimating Illicit Financial Flows: A Critical Guide to the Data, Methodologies, and Findings is authored by two of the economists most closely involved in the process to develop UN indicators of illicit financial flows. In it, they offer a critical survey of the existing data and methodologies, identifying the most promising avenues for future improvement and setting out their own proposals. They cover a range of corrupt practices aimed at obtaining immunity or impunity from criminal law, from market regulation, and from taxation.

Book Description

Illicit financial flows constitute a global phenomenon of massive but uncertain scale, which erodes government revenues and drives corruption in countries rich and poor. In 2015, the countries of the world committed to a target to reduce illicit flows, as part of the UN Sustainable Development Goals. But five years later, there is still no agreement on how that target should be monitored or how it will be achieved.Illicit financial flows occur through many different channels, whether they involve laundering the proceeds of crime or shifting profits of multinational companies. These deliberately hidden cross-border movements of assets and income streams depend on a set of common tools including opaque company accounts, legal vehicles for anonymous ownership, and the secrecy jurisdictions that provide these series. The overall effect is to reduce the revenue available to states and to weaken the quality of governance - leading to less money to support human development, and a lower likelihood of funds being well spent.

Estimating Illicit Financial Flows: A Critical Guide to the Data, Methodologies, and Findings is authored by two of the economists most closely involved in the process to develop UN indicators of illicit financial flows. In it, they offer a critical survey of the existing data and methodologies, identifying the most promising avenues for future improvement and setting out their own proposals. They cover a range of corrupt practices aimed at obtaining immunity or impunity from criminal law, from market regulation, and from taxation.

This open book is licensed under a Creative Commons License (CC BY-NC-ND). You can download Estimating Illicit Financial Flows ebook for free in PDF format (3.1 MB).

Table of Contents

Part 1

Illicit financial flows

Chapter 1

History and overview of 'IFF'

Part 2

Estimates of IFF scale

Chapter 2

Trade Estimates

Chapter 3

Capital and Wealth Estimates

Chapter 4

International Corporate Tax Avoidance

Part 3

Proposals for IFF monitoring

Chapter 5

Beyond Scale: Risk- and Policy-based Indicators

Chapter 6

New Proposals for IFF Indicators in the Sustainable Development Goals

Chapter 7

Conclusion: Estimating illicit financial flows

Book Details

Title

Estimating Illicit Financial Flows

Publisher

Oxford University Press

Published

2020

Pages

224

Edition

1

Language

English

ISBN13 Digital

9780198854418

ISBN10 Digital

0198854412

PDF Size

3.1 MB

License

Related Books

Intermediate Financial Accounting Volume 1 developed in collaboration by Athabasca University and Lyryx, is intended for a first course in Intermediate Financial Accounting, and presumes that students have already completed one or two Introductory Financial Accounting courses. The textbook reflects current International Financial Reporting Standard...

Intermediate Financial Accounting Volume 2 developed in collaboration by Athabasca University and Lyryx, is intended for the second of two in Intermediate Financial Accounting courses. It presumes that students have already completed the Introductory Financial Accounting, and the first Intermediate Financing Accounting course. The textbook reflects...

This book discusses the risks and opportunities that arise in Emerging Asia given the context of a new environment in global liquidity and capital flows. It elaborates on the need to ensure financial and overall economic stability in the region through improved financial regulation and other policy measures to minimize the emergent risks. "Man...

The Jingshan Report is a collection of research papers on key issues for China's financial opening, including reform of the RMB exchange rate regime, management of cross-border capital flows and financial support for the Belt and Road Initiative. Authored by leading experts in the relevant fields, the report examines the evolution, current sta...

This book is intended for an undergraduate or MBA level Financial Accounting course. It covers the standard topics in a standard sequence, utilizing the Socratic method of asking and answering questions....

This book is for those whose financial management focus is on small businesses. For you, we adapt the traditional financial management themes emphasized in corporate financial management courses to meet the needs of small businesses.

Many financial managers of small businesses come from farms or agribusinesses. Others are interested in working f...